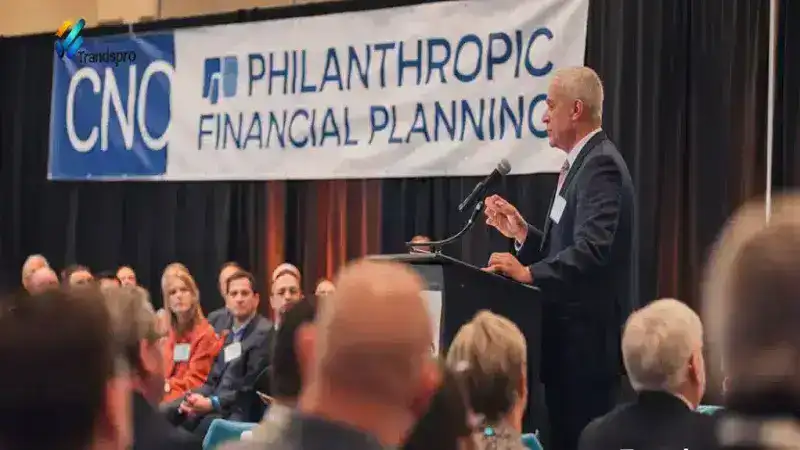

CNO Philanthropic Financial Planning: A Comprehensive Guide

Financial planning has evolved beyond securing personal wealth and achieving retirement goals. Today, it often includes a purpose-driven approach that incorporates giving back to the community and supporting meaningful causes. This is where CNO philanthropic financial planning emerges as a strategic approach, blending financial foresight with charitable intentions. This article will explore the concept, benefits, strategies, and implementation of CNO philanthropic financial planning, offering actionable insights to achieve financial goals while making a positive impact.

What Is CNO Philanthropic Financial Planning?

CNO philanthropic financial planning is a tailored approach to managing wealth that prioritizes charitable giving alongside traditional financial objectives. It involves creating a strategic plan that aligns personal, family, or organizational values with financial decisions, enabling the allocation of resources toward philanthropic efforts.

The term “CNO” reflects a growing trend among Chief Nonprofit Officers, financial professionals, and philanthropists to focus on community-oriented goals in their financial planning. This approach ensures that wealth is managed effectively while simultaneously fostering social responsibility.

Why Incorporate Philanthropy into Financial Planning?

1. Personal Fulfillment

Giving back can provide immense personal satisfaction. Contributing to causes that resonate with your values creates a sense of purpose and fulfillment that traditional financial goals may not always provide.

2. Tax Benefits

Charitable giving often comes with significant tax advantages. Contributions to qualified organizations can reduce taxable income, estate taxes, and capital gains taxes, maximizing the overall financial impact.

3. Legacy Building

Philanthropic financial planning allows individuals and families to build a lasting legacy. By funding scholarships, community programs, or research initiatives, your wealth can have a long-term impact.

4. Enhanced Community Impact

Through well-structured philanthropic plans, individuals and organizations can address critical social issues such as education, healthcare, and poverty, leaving the world a better place.

Core Strategies for Effective CNO Philanthropic Financial Planning

1. Define Your Philanthropic Vision

Start by identifying the causes you’re passionate about. Whether it’s education, environmental sustainability, or healthcare, clarity about your values will guide your decisions.

2. Choose the Right Giving Vehicles

There are several avenues for philanthropy, each with unique benefits:

- Donor-Advised Funds (DAFs): Allow you to contribute assets, receive immediate tax benefits, and recommend grants over time.

- Private Foundations: Offer greater control over charitable activities but come with higher administrative costs.

- Charitable Trusts: Enable a combination of income generation and giving, ideal for estate planning.

- Direct Contributions: Simple and straightforward, providing immediate support to chosen charities.

3. Collaborate with Professionals

Work with financial advisors, attorneys, and tax experts to structure a plan that balances your financial goals with philanthropic objectives. Professionals can help navigate the complexities of charitable giving, ensuring compliance and efficiency.

4. Integrate Philanthropy with Estate Planning

Incorporating philanthropy into estate planning allows you to allocate assets to charitable causes while preserving wealth for heirs. Strategies like charitable remainder trusts and bequests can achieve this balance effectively.

5. Measure and Adjust

Set benchmarks to assess the impact of your giving. Regularly review your philanthropic financial plan to ensure it aligns with changing financial circumstances and evolving social needs.

Key Challenges and How to Overcome Them

1. Balancing Personal and Philanthropic Goals

It’s essential to maintain a balance between giving and personal financial security. Prioritize creating a robust financial foundation before committing substantial resources to philanthropy.

2. Navigating Complex Regulations

Charitable giving involves intricate legal and tax frameworks. Partnering with experts who specialize in philanthropic financial planning can mitigate these challenges.

3. Ensuring Meaningful Impact

To avoid ineffective or redundant contributions, research the organizations and causes you support. Focus on initiatives that deliver measurable and sustainable outcomes.

Real-Life Examples of Philanthropic Financial Planning

1. The Gates Foundation

Bill and Melinda Gates exemplify philanthropic financial planning by dedicating their wealth to global health, education, and poverty alleviation through their foundation. They’ve structured their giving to maximize social impact while maintaining financial sustainability.

2. Corporate Giving Programs

Companies like CNO Financial Group incorporate philanthropy into their corporate financial planning by supporting community initiatives, aligning business success with social responsibility.

3. Individual Donor Stories

Many high-net-worth individuals use donor-advised funds and charitable trusts to support local causes, showcasing how personal wealth can drive community development.

Getting Started with CNO Philanthropic Financial Planning

Step 1: Assess Your Financial Situation

Review your income, assets, liabilities, and long-term financial goals to determine how much you can allocate toward philanthropy.

Step 2: Set Clear Objectives

Outline what you want to achieve through your philanthropic efforts, such as funding scholarships, supporting local shelters, or addressing global challenges.

Step 3: Build a Customized Plan

Collaborate with professionals to design a comprehensive plan that incorporates giving vehicles, tax strategies, and estate planning tools.

Step 4: Take Action

Start small if necessary, and scale your philanthropic efforts as your financial situation allows. Remember, every contribution, no matter the size, makes a difference.

Conclusion

CNO Philanthropic Financial Planning is an inspiring and practical approach to managing wealth with purpose. By aligning your financial goals with your values, you can create a meaningful legacy, benefit from tax advantages, and contribute to a better world. Whether you’re an individual, a family, or an organization, this strategy offers the tools and insights to make impactful and sustainable contributions to society. See More